Ireland has minimum standard employment legislation in place to provide rights to all employees. Rights can vary between industries, but there are minimum standards in place. Below are small excerpts of these standards.

The employee must receive a written contract clearly outlining the terms and conditions of their employment that includes details of the following information:

Employees must receive payslips which clearly detail gross pay and deductions.

The amount that you get paid is typically negotiated between you and your employer. However, in some sectors the rates of pay are set by Registered Employment Agreements (REAs) made by collective agreements.

Ireland has a National Minimum Wage Act which sets the minimum wage for trainees, employees under 18 years of age, and adult employees 18 years of age and over. This does not stop the employer from offering a higher wage, but ensures that they provide you a minimum. For more information about how these rates are calculated, see the Citizens Information website.

Like most European countries, incomes are less that you might expect in other countries such as the U.S and Australia. However, those with unique skills in high demand may find themselves being offered high salaries.

All employees that have worked at least 1365 hours per year are entitled to a minimum of four weeks paid holiday per year. This includes full time, part time, temporary or casual employees.

Most employees are entitled to paid leave on public holidays and they receive the following:

If the public holiday falls on a weekend, you do not have the automatic entitlement to have the next working day off. It is up to your employer whether you need to work that day. They can provide you with any of the above four options.

Part-time employees who have not worked for their employer at least 40 hours in total in the 5 weeks before the public holiday are not entitled to the holiday benefits.

Employees have no right to paid sick leave under the employment laws. It is up to the employer to decide on their own sick leave policy and they must provide you with the terms of this in your employment contract.

All female employees are entitled to maternity leave if they become pregnant whilst in employment. Ireland provides 26 weeks of maternity leave benefits as well as 16 weeks of additional unpaid maternity leave. At least 2 weeks of leave must be taken before the expected birth date and at least 4 weeks after.

The maternity benefit will only be paid if you have made sufficient PRSI contributions (social insurance) to be eligible. Applications for the benefit should be made at least six weeks before maternity leave is due to start, or 12 weeks if self-employed. The Department of Social Protection is responsible for issuing Maternity Benefit.

Learn more about the Irish Maternity benefit from the Irish Department of Social Protection.

There is currently no paternity leave in the Irish employment laws. However, some employers may include this in their own leave policies or allow their employees to take annual leave. As of 2015, there is talk of introducing 2 weeks paternity leave, which will be decided on at the end of the year.

The Irish generally have a good work life balance. Days of work are typically Monday to Friday, 9am to 5.30pm, unless of course you work in an industry that requires you to work outside of these times. Those in high level roles may be expected to work extended hours.

Employees are entitled to take a 15 minute break after working 4.5 hours, but are not entitled to be paid for these breaks. However, many employers do pay staff for this time. If employees work more than 6 hours, then they would typically get a one hour unpaid lunch break.

The average working week is 39 hours. The legal maximum working week is 48 hours. Those that work less than 5 days a week are considered ‘part time’.

Those expected to work on Sundays are required to be compensated by being paid at a higher rate.

To learn more about Ireland’s employment legislation and rights, go to:

First of all, if you are not from the European Economic Area (EEA), then it’s important that you have the right visa or work permit before applying for work.

To be successful, you will need a good level of spoken and written English. Being fluent in another language can also be a real advantage for work with multinational companies. Those with skills in the technology, science, finance, HR and health areas are in high demand.

If your trade or profession requires registration, then you should get in contact with the relevant body as soon as possible to have your qualifications assessed. You may need to undertake an examination or further training to meet the expected skills and qualifications.

If you are seeking a job that requires qualifications, you will need to provide proof. You may be asked to provide a qualification recognition certificate in order to provide evidence that your credentials are formally recognised in Ireland. To apply for this certificate, contact Qualifications Recognition Ireland. Degrees from most Western countries are usually considered equivalent to Irish qualifications.

Recruitment agencies can be a great resource for you to tap into when carrying out your job hunt. They actively recruit skilled workers in the high demand industries.

However, you may find it very difficult to get any response from the job agencies before you arrive in Ireland. If you don’t have much luck, it’s best to contact them once you’re here in Ireland. This will show that you are serious and have made the move and your not just thinking about it. Once they see you have an Irish phone number and address, you will hopefully see more interest from recruiters.

Unfortunately recruitment agencies receive vast amounts of enquiries so may not be very responsive. In that case, it would be best for you to register with several recruitment agencies to increase your chances of success, however, it is not recommended that you apply for the same job through more than one agency.

There are a large number of recruitment agencies throughout Ireland. Some focus on specific industries, but others are broader. A good place to start your search would be using the agency directory and agency list on the National Recruitment Federation (NRF) website. The NRF is a voluntary organisation that grants membership to recruitment agencies that meet their criteria of excellence.

There are an ever growing number of job websites offering a variety of employment opportunities. As well as jobs, they also provide lots of great advice about tailoring your cover letter and CV for the Irish market as well as interview tips. Employers are increasingly choosing to advertise online over the traditional newspapers.

Social Media like Twitter, Facebook, Google+, and LinkedIn have become a way for people to share and promote job opportunities amongst like minded people. If you work in a particular industry that uses social media in this way, then try following people in key roles to learn more about any opportunities that may be available. Make sure that you spend time on developing your LinkedIn profile as it is a popular website in Ireland and many businesses use it to headhunt for key roles.

Although much of the job advertising is done via job websites, there are still many jobs advertised in the Irish newspapers. The Irish Times both publishes jobs and host their own web based job search on their website.

The Irish Independent, which also publishes the Sunday Independent, and The Evening Herald publish job advertisements and on their websites, their online job search links to the irishjobs.ie website.

The local newspapers are also a good place to search for jobs.

It is worth an internet search for open days, recruitment days or events that may be occurring in your area. It will give you the chance to make connections and learn more about the different companies and their job opportunities. It could even lead to a job.

Struggling to get work? Then the next best step is to gain work experience by volunteering through Volunteer Ireland. This website not only posts volunteer opportunities from all over Ireland, but it also provides details about how to get the volunteer position that your after.

The Government contracts organisations to provide their employment services.

The central point for these services is the Local Employment Service Network (LESN). Their website will provide the details of your nearest local centre.

These centres provide support to jobseekers including assistance with preparing a CV, finding a job, interview coaching, and also information on support available for starting your own business.

For immigrants living in Ireland, EPIC can provide support with preparing a CV and cover letter, advice on how to look for a job as well as interview skills. You can find EPIC on Facebook.

Dress for success. For your job interviews make a good first impression and show your respect by wearing professional attire.

Unless you are expected to wear a uniform, many Irish workplaces don’t have official dress codes as it is usually implied. Even if there is a dress code, they can be quite generalised. The expected attire can vary from smart casual to professional, depending on the workplace culture. Once you start your new job, it would be safer to turn up in a professional outfit on your first day. This will make a good impression and avoid any possible embarrassment on your part. You can always tone it down the next day.

Disclaimer: This article covers general information about finding a job in Ireland and does not take your individual circumstances into account. Please use it as a guide only.

A Personal Public Service (PPS) number is a unique number that government bodies use to identify you. You will need to give this number to your employer as soon as possible so that they can advise the Revenue Commissioners for your tax deductions. You may also need it when setting up a bank account or accessing public services.

The PPS number will also give you access to Irish services such as:

You cannot apply for a PPS number before you arrive in Ireland. You must be living in Ireland in order to apply.

As well evidence of an address, you will also need to show that you have a requirement for one, otherwise it won’t be issued. For example, you will only be issued with a PPS number if you are about to commence employment. Looking for employment is not a considered a requirement. Be aware that an employer requiring a PPS number as part of the application process is in breach of the legislation.

Your PPS number will have seven numbers and will end in two letters, making up nine characters in total. Old PPS numbers are only eight characters as they only have one letter at the end.

You need to go to your local Department of Social Protection and complete an application form. Be prepared to line up! It can get pretty busy at these offices.

If you are not Irish, you will need to provide the following documents:

Proof of address can be difficult to provide if you have only just arrived and are immediately commencing employment. In this case, your employer may apply on your behalf.

When a child is born in Ireland, they are given a PPS number when their birth is registered with the General Register Office. In this case, they do not need to apply for one. However, if both parents live outside of the state, this will not automatically occur and you will still need to apply for one.

For children living in, but not born in Ireland the parent/guardian must apply for one. However, the parent/guardian must already have their own PPS number in order for the child to be registered and linked with them.

Your PPS number will be recorded on your tax documents, your payslip and any letter or cards that are issued from the social welfare office, medical payment scheme or tax office.

You must notify the Department of Social Protection of your change of address as they will update your record. You can do this by either calling or writing to them.

Employees pay income tax through the Irish PAYE (Pay As You Earn) system. The PAYE system means that your employer deducts the tax that you owe directly from your wages prior to paying you. Your employer gives this tax directly to the Revenue Commissioners.

If you have spent 183 or more days in the tax year or 280 days over two years living in Ireland, then you are considered a resident for tax purposes. If you are out of Ireland for 30 days or less, it won’t be counted towards the 280 days. This means that you will be expected to pay tax on your income inside and outside of Ireland. On the other hand, non-residents only have to pay taxes on their income inside Ireland.

Be aware that Irish residents are liable to pay tax on both their Irish income as well as their foreign income, including foreign pensions. They are also liable for taxation in the foreign country, however, Ireland has double taxation agreements with a number of countries. Refer to the Tax Treaties section of the Irish Revenue website. You can obtain tax relief if your country of residence is among them.

As soon as you get a job, you need to apply to the Department of Social Protection for a Personal Public Service Number (PPSN). Once you receive your PPSN, give it to your employer.

You then need to apply for a certificate of tax credits by completing the tax Form 12A which you can get from your employer or from the Irish Revenue Department website. Take the time to complete this Form 12A honestly and accurately and renew it if your circumstances change, otherwise you could find yourself in trouble for falsely claiming tax credits as the Revenue department carries out regular revenue audits.

Once completed, the Form 12A needs to be given to the local tax office. They will then send you a certificate of tax credits and provide a copy to your employer so that they can correctly tax your pay. If you don’t get this completed, then eventually your employer will have to apply the much higher emergency tax rate until you have this in place.

Tax credits reduce the amount of income tax that you are required to pay. The tax credits you receive are dependent on your personal circumstances, for example, the single person tax credit and married person’s tax credits. For more information, visit the Irish Revenue Department website.

The amount of tax that you pay depends on your personal circumstances and the tax credits that you are eligible for. For the current tax rates, visit the Irish Revenue Department.

Your employer will give you a P60 at the end of the year. The P60 is a statement of your wages and the total tax that you have paid for the year. If you have only not earned any other income during the financial year, you may not have to file a tax return. However, you can opt to complete the tax Form 12 in order to claim tax relief on tax credits and allowances like medical expenses. You can obtain this form from the tax office or the Irish Revenue website.

However, you must to lodge a self-assessed tax return of you are a:

You can lodge your tax return by sending it into the tax office. Alternately, you can lodge your tax return online using the Revenues On-Line Service (ROS). In order to use this service you must complete the ROS registration process. You will then be issued a personal ROS access number in the mail which will enable you to file your tax return online. After lodging your tax return, the tax office will provide you with a statement of your tax liability called a P21.

A P21 is your statement from the tax office that displays:

The statement will advise you on whether you have overpaid or underpaid your taxes for the financial year. If you are applying for a loan or mortgage, you may need to give your P21 to the bank as proof of your earnings.

If you have overpaid tax tax, it will be paid to you either by cheque or into your bank account if you have given Revenue your bank details. If you have not paid enough tax, then you can pay the outstanding amount by:

Your employer must give you a P45, which is a statement of your pay and how much tax that they have deducted. This form is essential and must be given to your new employer. If you have become unemployed, you will need the P45 to claim a tax refund and to apply for social welfare benefits.

Make sure that you obtain your P45 from your employer. You may be eligible for a tax refund. To apply, complete the tax Form P50 which is available from your local tax office and the Revenue Department website.

Becoming an Au Pair gives you the opportunity to live and work in a different country. It’s a great way to experience a new culture and improve your English. Although there is no official Au Pair program in Ireland, it is possible to become one.

The working hours for an Au Pair in Ireland are not specified but generally 20 hours if you are on a student visa or approximately 35 hours per week. You can expect to be paid anywhere from €80 to €120 per week.

There have been concerns raised in Ireland over whether Au Pairs should be receiving the legal minimum wage with a small deduction for room and board.

The free time and holidays for an Au Pair in Ireland are not specified, but it is recommended that Au Pairs receive two days free time per week and one weeks paid holidays for every six months worked. You may be expected to babysit on weekends.

‘Au Pair’ means on an equal footing and you should not be treated like a servant. The host family is expected to treat you as a member of their family. They must provide you with your own bedroom, three meals per day and also have free access to the family home.

Au Pair duties include childcare and light housework. For example:

Many families require the Au Pair to be able to drive in order to transport the children to school and appointments. If you are required to drive as an Au Pair in Ireland, you will need a full, valid driver’s licence. If the family provides the Au Pair with a car for private use, it would be expected that the Au Pair pay for the petrol used.

Discuss with your host family what happens if you have a car accident, who pays, and have your agreements put in the contract.

The Au Pair is liable for all costs, however, in some cases the host family may contribute to the cost if the Au Pair is travelling a long way.

It is strongly recommended that Au Pairs obtain comprehensive travel insurance, which covers medical, accident and liability costs. This would be at the Au Pair’s own expense.

Non-EU citizens who have entered with a student visa must have adequate private medical insurance.

An Au Pair in Ireland needs to have a working knowledge of English. Many take the opportunity to attend a language course or study while in Ireland, but this is not a requirement. Typically the Au Pair would bear the cost of the course, but there are cases where the host family may assist.

Looking to become an Au Pair or wanting to host an Au Pair? There are a number of sites that can assist you. Some sites simply act as a platform for potential Au Pairs to meet host families; others are agencies that match Au Pairs with a family for a fee.

EU and EFTA nationals do not require a work permit, but must register with local authorities (Garda) after arriving in Ireland. Au Pairs from Romania and Bulgaria need a work permit.

In order for non-EU nationals to become an au pair in Ireland, they are required to have a Work Permit. Some of the types of work permits that you may be able to apply for are:

For information about obtaining a visa, visit the Irish Naturalisation and Immigration Service.

Be aware that there are a number of scams that people get caught up in. If the ‘host family’ asks you to hand over large sums of money for e.g. visas, then this is most likely a scam. Vice versa, ‘Au Pairs’ who request money from their host family prior to commencing is most likely a scam as the Au Pair is expected to pay for their own travel expenses.

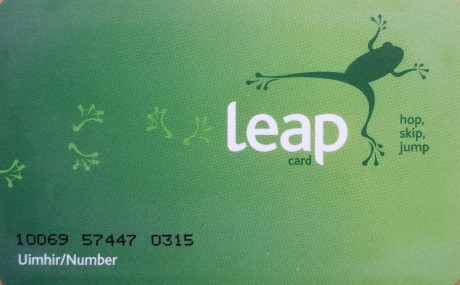

The Leap Card can be used on all Dublin public transport. Visitors to Dublin should consider purchasing the Leap Visitor Card which is a prepaid ticket that provides you unlimited travel for up to 72 hours/3 days on Dublin public transport.

Dublin city has a tram network called the LUAS which consists of two lines (currently under expansion):

There are electronic displays at each stop advising you of when the next tram is due, as well as announcements. The Dublin Transport Real Time Ireland App can be used in conjunction with this service. The trams tend to get very cramped, so be prepared to squeeze yourself in.

You can purchase your tram ticket from the ticket machine located at each stop but for a cheaper fare use a Leap Card.

Touch your card on the Leap Card device on the platform before getting into the tram. It will deduct the maximum fare, but when you get off the tram, you need to touch your card to the Leap Card device at the station you are departing at. It will then adjust the fare accordingly and charge you the correct fare for your trip, unless of course your trip costs the maximum amount.

Buses are the most widely used form of public transport in Dublin city. They are operated by Dublin Bus. The Bus Arrival Information Service is based on the GPS locations of buses, provides real time estimates of bus arrivals on electronic information boards at each stop. The Dublin Transport Real Time Ireland App can be used in conjunction with this service. The Leap Card can be used on these buses.

The Leap card can be used on the following Dublin commuter services:

You can purchase your ticket from the driver on board the bus, but for a cheaper fare use a Leap Card.

Touch your Leap Card onto the device located beside the driver and tell them where you wish to go. They will deduct the correct fare. You do not need to touch off.

On the Airlink 747 bus, touch the ticket against the Leap Card validator device on the right-hand side as you enter the bus. However, if you want a cheaper return ticket, you will need to purchase it with cash from the driver. Make sure you keep the ticket in a safe place as you will need it for your return trip.

Dublin has a commuter rail system. There are four main lines, designated Northern Commuter, Western Commuter, South Eastern Commuter, and South Western Commuter. The trains are operated by Irish Rail.

The Dublin Area Rapid Transit (locally known as the DART) serves the Dublin bay commuter belt:

There are electronic displays at each stop advising you of when the next train is due, as well as announcements. The Dublin Transport Real Time Ireland App can be used in conjunction with this service.

You can purchase your train ticket from the ticket machine located at each stop, but for a cheaper fare use a Leap Card.

To get to your train, you will need to touch your card on the Leap Card device at the platform entry to get through the electronic gates. It will deduct the maximum fare. However, once you get off at your stop and touch your card on the Leap Card device to get through the exit gates. It will charge the correct fare for your trip and credit your account for the difference, unless of course your trip costs the maximum amount.

You can download the free Real Time Ireland app from the Apple App Store or the Google Play Store. It provides real time data for Dublin Bus, Bus Éireann, DART, LUAS and Irish Rail. It also gives reminders to notify you when the bus is approaching your stop, or when you are near a certain bus stop, enables you to create reminders and access travel updates etc…

The Leap Card can be used on the Cork bus services and the Cork – Cobh/Midleton train lines.

The city buses are run by Bus Éireann which services areas like Cork City, Knocknaheeny, Ballinlough, Cork, Mahon, Cork, Mayfield, Cork, Frankfield, Cork, Ballintemple and Farranree, Cork and suburban routes serving towns such as Glanmire, Ballincollig, Carrigaline, Douglas, Midleton, Mallow, Cobh and Goleen.

You can purchase your ticket from the driver on board the bus, but for a cheaper fare use a Leap Card.

Touch your Leap Card onto the device located beside the driver and tell them where you wish to go. They will deduct the correct fare. You do not need to touch off.

There are 3 suburban train lines in the Cork suburban rail service is run by Irish Rail.

You can purchase your train ticket from the ticket machine located at each stop, but for a cheaper fare use a Leap Card.

To get to your train, you will need to touch your card on the Leap Card device at the platform entry to get through the electronic gates. It will deduct the maximum fare. However, once you get off at your stop and touch your card on the Leap Card device to get through the exit gates. It will charge the correct fare for your trip and credit your account for the difference, unless of course your trip costs the maximum amount.

There is a car ferry operated by Cross River Ferries which runs between Rushbrooke and Passage West.

No advance purchase/bookings necessary and there are commuter weekly tickets available

Capital City: Dublin

Provinces and Counties: There are four provinces in Ireland – Connacht, Leinster, Munster and Ulster. There was once a fifth province called Meath, but it was incorporated into Leinster and Ulster. These provinces contain 32 traditional counties, six of which are located in Northern Ireland.

Population: Over 4.5 million

Language: English, but Irish is the official language but is only spoken in the Gaeltacht communities along the west coast.

Currency: Euro (€)

Time Zone: GMT+1 (GMT+1 March to October)

Country Code: +353

International Access Code: 00

Emergency Services (Police, Fire, Ambulance): In Ireland both phone numbers 999 and 112 exist equally and run in parallel. Regardless of which number you call in Ireland, there will be no difference and the call will be handled in the same manner.

Police Services: In Ireland, the Police services are referred to as the Gardai or “the guards”. An individual officer is called a garda (plural gardaí), or, informally, a “guard”. A police station is called a Garda station. The Gardai do not carry firearms.

Voltage: 230V/50hz

Visas Requirements: Not required by most citizens of Europe, Australia, New Zealand, USA and Canada. Learn more about Ireland’s visa requirements.

Embassies and Consulates in Ireland: For a full list of the foreign embassies and consulates in Ireland, refer to Ireland’s Department of Foreign Affairs website.

Refugee Support in Ireland: Refugee’s can access support and advice through the Irish Refugee Council and Refugee Legal Services through the Legal Aid Board.

Vaccinations: There are no required vaccinations for travelling to Ireland. Learn more about Ireland’s health care system.

Seasons: The traditional Irish seasons are Spring – February to April; Summer – May to July; Autumn – August to October; Winter – November to January. However, Ireland’s Met Office, Met Éireann, has the seasons occurring one month later than these traditional seasons.

Weather: Ireland’s weather is influenced by the Atlantic Ocean and consequently does not experience the extreme temperatures that other countries at similar latitudes. Irish weather is unpredictable and changeable, however, it never usually gets too extreme. The warm ocean current called the North Atlantic Drift keeps sea temperatures relatively mild and the coastal hills and mountains protect the island from strong winds coming off the ocean.

The temperature in Ireland is measured in celcius (0°C is equal to 32°F, use an online converter to assist you). Spring temperatures range from about 4 to 20°C; summer 8 to 26°C; autumn 9 to 25°C; and winter 4 to 14°C.

Measurements: Ireland uses the metric system. This means that liquids are measured in millilitres and litres, weight is measured in grams and kilograms, and distance and road speed signs are still displayed in kilometres. Since 2005 all new cars sold in Ireland have speedometers that display only kilometres per hour. However, people still like to measure themselves in stones and bars still use “pint of beer”.

Driving: Ireland drive on the left hand side of the road. Learn more about driving around in Ireland.

Public Transport: Learn more about getting around on Ireland’s public transport system.

Postcodes: Ireland rolled out postcodes in 2015. To find a post code visit Eircodes for more information.

Holidays: Ireland has nine public holidays. Learn more about Ireland’s public and school holidays. Employees generally receive four weeks of annual holidays per year.

Tipping: There is generally no tipping culture in Ireland.

Value Added Tax: Value Added Tax is charged at different rates for various goods and services. You can get an extensive list of VAT ratings from Ireland’s Revenue Commissioners.

If you are visiting Ireland, find out how you can save money by reclaiming your VAT.

Income Taxes: Find out more about Ireland’s income tax laws.

LGBT: Ireland is a pretty tolerant place for gays and lesbians. Bigger cities such as Dublin, Galway and Cork have well-established gay scenes. In 2015, Ireland overwhelmingly backed same-sex marriage in a historic referendum. However, you’ll still find pockets of homophobia throughout the island, particularly in smaller towns and rural areas.

Resources:

Disability: All new buildings have wheelchair access, and many hotels have installed lifts, ramps and other facilities. However, there are many old buildings in Ireland and many of these are not easily accessible to people with a disability. Fáilte Ireland and NITB’s accommodation guides indicate which places are wheelchair accessible.

In big cities, most buses have low-floor access and priority space on board and these are becoming more available on regional routes. Trains are accessible with help. In theory, if you call ahead, an employee of Irish Rail (Iarnród Éireann) will arrange to accompany you to the train. Newer trains have audio and visual information systems for visually impaired and hearing-impaired passengers.

Resources:

Vegan, Vegetarian, Coeliac & Gluten Intolerant: It is becoming much more common place for restaurants in Ireland to provide food options for the various dietary requirements. However, Ireland’s love of meat can make it difficult for vegetarians vegetarian and vegans. The Vegan Society of Ireland and The Vegetarian Society of Ireland provide useful information about where to shop and eat while living in Ireland.

Although the Irish have a high incidence of coeliac disease, there is a general lack of understanding of the dietary needs. The Coeliac Society of Ireland provides information and support for people living in Ireland who eat gluten free. They also contain a list of gluten free products available at the supermarkets in Ireland.

Drinking Laws: In an attempt to curb alcohol problems, Ireland has a number of strict alcohol laws in place.

The decision to relocate to another country can be difficult. This article seeks to assist you through the decision making process by outlining the considerations that need to be made and providing an overview of what moving to Ireland entails.

Moving to another country is not only stressful and daunting, but also expensive. If you are planning to move to Ireland as a family group, then take the time to discuss it as a family. Make sure that everyone gets the time to air their concerns.

Before committing to the move, consider renting a holiday home in your location of preference and stay for as long as possible. But remember, holidaying in Ireland is a lot different than actually living here.

Use the opportunity to connect with people in your job industry to see whether there are any job opportunities that would be available to you. Take note of the cost of living and go to the local pub and talk to the locals to find out more about the community. Particularly in smaller Irish communities, the locals can be very friendly and enjoy chatting to visitors.

Even if you decide to relocate to Ireland, it may not be feasible for you to do so with the strict immigration laws. Unless you have been offered a job with a company that will assist you to get a work permit, then you may find it difficult to gain the necessary permission to relocate and work in Ireland.

You also need to consider the actual cost of the move. Don’t underestimate the cost of relocating to another country. Even if you have a job lined up, unless your new employer is willing to foot the bill for your moving expenses, then you are going to need a significant sum of money just to cover the initial moving costs.

For example:

If you do eventually decide to make the move to Ireland, then you need to plan well in advance. To assist you, use this detailed Moving Checklist.

Ireland has three international airports located in Dublin, Cork and Shannon. It will depend on where you are flying from as to which airport options you will have available to you. Find out how to get to and from each airport in Ireland.

You can get a ferry to either the Republic of Ireland or Northern Ireland. Ferries are a popular choice for those coming from Europe and wanting to bring their car.

Irish ferries depart from:

There are a number of ferry companies that operate

Find cheap fares by using the comparetravel.ie ferry fare comparison website.

Moving your personal effects to Ireland will not be cheap. They typically charge by volume. If you have a minimal amount of items to ship then it may be cheaper to have your items placed in a shared shipping container. If you have a lot, then it may be more cost effective to pay for an entire shipping container.

If you only have a small amount of boxes to move, you may find it difficult to find a company willing to take on such a small job. But keep ringing around the companies and you will eventually find someone that will ship your goods. Prices vary wildly, so it’s worthwhile taking the time to get a number of quotes. I have not listed any moving companies because you would typically hire an international moving company based in your country who would then have a branch or contracts with companies in Ireland to deliver them to your new address.

Be aware that if you pack yourself, then moving companies typically won’t pay for breakages. You may be better off paying for the company to pack them for you. Also, if access to your current or new home is difficult, you may be charged more.

Be prepared to wait a long time for your shipped items to arrive in Ireland. When I moved from Australia, it took four months for mine to arrive! Depending on where your items are being shipped from, they may go through UK customs before being transported into Ireland. This can extend the shipping time.

When packing, make three piles – ‘definitely taking with me’, ‘definitely getting rid of’ and the ‘maybe’ pile. It you are able to begin sorting your things early, try packing up the ‘maybe’ items and putting them away for a while. Then, when you go through the items again closer to your moving date, it’s easier to make a final decision. Ask yourself, did you honestly miss any of it? If not, then do you really need to take it?

When it comes to your electrical goods you need to consider your options. You can get cheap adapter plugs in Ireland for about €2 from the bargain stores. You could also get the plug changed on your power cord changed. Standard voltage in Ireland is 230V AC, so if your electrical goods don’t run on this voltage you will have to get converters for them.

If you are going to bring your vehicle with you, then you will be liable to pay vehicle taxes as well as the other costs associated with maintaining a car in Ireland.

If you are planning to take a fridge freezer with you, make sure that you allow enough time for it to be defrosted. Do not pack perishables like food, plants and flammable items.

Make sure any clothing or bedding packed is clean. If items are left dirty for a length of time, then they can form yellowy brown oxidation stains that are extremely difficult to remove. If this does happen to you, then try scrubbing the stains with:

After treating with one or more of these options (sometimes on tough stains I’ve been know to try all of them), soak the items in a diluted bucket of oxygen bleach. Don’t be tempted to use chlorine bleach on these types of stains as it will just set it and then you will never get it out.

Getting rid of your unwanted stuff takes a lot of work and is time consuming. Take photos of each item and set a price. You will need to be flexible with the price if you want to get rid of things quickly.

Sell items of value online using Ebay, Gumtree etc… You can also try selling your items by posting or emailing the list through your work and kids schools and on community notice boards. Try and include lots of photos.

Schedule time to hold a garage sale. Make sure you advertise it well via social media, local community sites and even putting signs out. On the day, make sure that you lock up your house, secure valuables, and have someone to help you keep an eye on things. If you don’t like the idea of holding a garage sale, then take your items to a local car boot sale or flea market.

Take a scan or photo of all of your important documents and save them onto your own personal storage device and the cloud, e.g. Dropbox account, to ensure they don’t get lost.

Take this opportunity to scan all of your non-digital photos. It’s actually very cheap to get this done professionally. This way, if the originals get lost, at least you have a copy of them.

It’s safer to transport your most important documents with you in your carry on luggage to reduce the risk of them being stolen or lost. It also makes them easily accessible if you need them as you go through Irish immigration.

For example:

Disclaimer: Official policy and legislation regarding immigration continually changes. This information is meant to be used as a guide only. Please refer to the Irish Immigration and Naturalisation website for the latest information.

Unless you are an EU/EEA citizen then the Irish immigration process can be time consuming and frustrating. Please be aware that this is only meant to be used as a guide. For more detailed, up to date information, please refer to the Irish Immigration and Naturalisation website.

You can access free immigration legal advice through the voluntary organisation FLAC. The FLAC website provides details of their telephone and referral services, Legal Advice Centres and online legal information.

Refugee’s arriving in Ireland can access support and advice through the Irish Refugee Council and Refugee Legal Services through the Legal Aid Board.

Visitors from these countries (including British dependent territories) do not need a visa to visit Ireland and can enter using either their passport or their national identity card.

Under this programme, citizens of holders of certain categories of Short Stay ‘C’ UK visas to travel to Ireland within the time remaining on their current leave to remain in the UK without the requirement to obtain an Irish visa.

The countries included in the Programme are:

Eastern Europe: Belarus, Bosnia and Herzegovina, Montenegro, Russian Federation, Serbia, Turkey and Ukraine

Middle East: Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the United Arab Emirates

Asia: India, Kazakhstan, Peoples Republic of China*, Thailand, Uzbekistan

To find out if you need to apply for a visa to visit Ireland, refer to the list of visa exempt countries.

All other citizens from countries not on the Irish visa exempt list or the Irish Short Stay Visa Waiver Programme list need a full passport as well as a short stay ‘C’ visa in order to visit Ireland. This short visit visa is valid for a maximum of 90 days and you can apply for either a single entry or a multiple entry short stay ‘C’ visa.

To obtain an Irish short stay visa, you need to apply to the Irish embassy or consulate in your country of permanent residence. You may be required to attend an interview. If there is no Irish embassy or consulate in your country of residence, you may apply to any Irish embassy or consulate, or direct to the Visa Office in Dublin.

EU/EEA and Swiss nationals are free to study in Ireland and there are no special requirements. You do not need to register with the immigration authorities.

Non EU/EEA and Swiss nationals must gain a place in an Irish educational institution in order to come and study in Ireland. Please be aware that you cannot come to Ireland to do a part-time or distance learning course. However, you can come to Ireland to undertake a short term English language course.

To find out if you need to apply for a visa to visit Ireland, refer to the list of visa exempt countries.

Your passport will need to valid for at least six months after the completion of your course. In addition, all non-EU/EEA students must register with the local Garda National Immigration Bureau.

Students from countries requiring a visa to enter Ireland must apply for a student visa. When you arrive in Ireland you must also register with the local Garda National Immigration Bureau.

You must apply for your student visa online using the AVATS online facility. The application will only be processed once the online form is completed and the required documentation, passport photograph and appropriate fee are received by the relevant office.

As part of the application process you will need to demonstrate that you have access to €7,000 to support yourself financially during your stay. You will need to have a letter from your course provider (e.g. college or university) confirming that you have been accepted and evidence that the course fees have been paid in full. Your passport will also need to be valid for at least six months after the completion of your course.

Non-EU/EEA students are not entitled to Irish social welfare, but those with a Stamp 2 are allowed to work up to 20 hours a week during term time. During the holiday periods May to August and from 15 December to 15 January, you can work up to 40 hours a week.

Students with stamp 2A permission are not allowed to work.

All non-EU/EEA citizens, whether visa-required or not, are subject to ordinary immigration controls when they arrive in the country. Although you may have successfully obtained a visa (or exempt from needing one), you may still be refused entry by Irish immigration officials when you arrive. When arriving in Ireland you should show your acceptance letter from your school, college or university to the immigration officer so that you receive the correct immigration permission stamp in your passport.

Please note:

To ensure you have no difficulties, it’s recommended that you have your documents ready to show to the officer.

Non EU/EEA students need to register at the Garda National Immigration Bureau (GNIB) and show:

On successful completion of your GNIB registration you will be issued with a GNIB Card/residence permit. This is valid for one year or for single semester students, to the end of their course. Your GNIB card is valid for one year (unless you are a single semester student). It must be renewed each year by the expiry date.

Have the right to stay in Ireland with your family members for up to 3 months. However, if you plan to stay more than 3 months, you must either:

You do not need an employment permit or residence card to live here and are entitled to be treated the same as Irish workers.

Learn more about the residence rights of EU/EEA nationals in Ireland.

Are entitled to live in and work in Ireland without any conditions or restrictions and are entitled to be treated the same as Irish workers.

If you are from outside the EU/EEA or Switzerland then you need a permit in order to live and work in Ireland. These can be very difficult to obtain depending on your circumstances. When you apply for a work permit, you will be required to pay a fee.

These permits are available for occupations with an annual salary of €30,000 or more. Only in exceptional cases will jobs earning less than this be considered. Normally, a labour market needs test.

This permit is available for most occupations with annual salary of over €60,000. They are also available for occupations on the Highly Skilled Occupations List with that pay an annual salary of at least €30,000. There is no requirement for a labour market needs test.

This permit applies to spouses, recognised partners, civil partners and dependants of holders of Critical Skills Employment Permits or researchers under a hosting agreement. There is no requirement for a labour market needs test.

Allow foreign nationals who entered the State on a valid employment permit but who fell out of the system through no fault of their own, or have been badly treated or exploited in the workplace, to work again. Applicants for a Reactivation Employment Permit must first apply for a temporary immigration permission stamp 1 to the Irish Naturalisation and Immigration Service (INIS). You can find the eligibility criteria, guidelines and application form on inis.gov.ie.

For foreign undertakings with a contract to provide services to an Irish entity. These permits allow the transfer of non-EEA employees to work on the Irish contract in Ireland while remaining on an employment contract outside the State. Generally, a labour market needs test is required.

Allows senior management, key personnel and trainees working in an overseas branch of a multinational company to transfer to the Irish branch. They must be earning at least €40,000 a year (trainees must be earning at least €30,000 a year) and have been working for the company for a minimum of 12 months.

Available to non-EEA national full-time students who are enrolled in a third-level institution outside Ireland and have a work experience job offer in the State.

For employment in the State for the development, operation and capacity of sporting and cultural activities.

For those employed in the State under prescribed agreements, e.g. the Fulbright Program for researchers and academics.

Citizens of Argentina, Australia, Canada, Hong Kong, USA, Japan, New Zealand, South Korea and Taiwan may apply for a Working Holiday visa as part of a reciprocal agreement between these countries and Ireland. You need to have sufficient funds to support yourself while looking for work as well.

As a non-EU national, you must register with the Garda National Immigration Bureau and there is a fee of €300 for the issue of a Garda registration card.

US citizens can enter Ireland on a Work and Travel visa, but they must either be in post-secondary education or have graduated within the last 12 months. In addition, they will need to:

Non-EU/EEA students are not entitled to Irish social welfare, but those with a Stamp 2 are allowed to work up to 20 hours a week during term time. During the holiday periods May to August and from 15 December to 15 January, you can work up to 40 hours a week.

Students with stamp 2A permission are not allowed to work.

All non-EU/EEA citizens, whether visa-required or not, are subject to ordinary immigration controls when they arrive in the country. Although you may have successfully obtained a work permit, you may still be refused entry by Irish immigration officials when you arrive. Therefore, you should have originals or copies of all the documents submitted with work permit ready to show to the officer.

Please note:

In order to register, you should go to your local immigration registration office and ask for the registration officer as soon as possible following your arrival in Ireland- see ‘Where to apply’ for details of addresses.

You will need to provide the following information about yourself:

The registration officer may also take your fingerprints, signature, and photo and may ask for further details.

On successful completion of your GNIB registration you will be issued with a GNIB Card/residence permit.

Irish citizens returning to Ireland have an automatic right to reside here.

May live in Ireland without any conditions or restrictions.

Can remain in Ireland with your family for up to 3 months without restriction. But if you are retired and plan to stay more than 3 months, you need sufficient resources and sickness insurance to ensure that you do not become a burden on the State.

If you are not from a visa exempt country then you will need to obtain a visa to get into Ireland. Once you arrive in Ireland, you must obtain permission to remain by registering with your local Garda National Immigration Bureau and prove that you have sufficient resources and health insurance to support yourself to ensure that you do not become a burden on the State.

Since March 2015, the Ireland Naturalisation and Immigration Service (INIS) changed the standards by which non-EU retirees are determined to be financially suitable for residency. The new rule requires that retirees have an annual income of no less than €50,000 per person, (€100,000 for a married couple) for the remainder of their lives in Ireland, regardless of their existing cash on hand or lack of debt.

Retirees have also had their immigration status changed from Stamp 3 to Stamp 0, which, according to the INIS website is “a low level immigration status which is not intended to be reckonable for Long Term Residence or Citizenship. It is granted to persons who have been approved by INIS for a limited and specific stay in Ireland.”

All non-EU/EEA citizens, whether visa-required or not, are subject to ordinary immigration controls when they arrive in the country. Although you may have successfully obtained a visa (or not even need one), you may still be refused entry by Irish immigration officials when you arrive.

Please note:

To ensure you have no difficulties, it’s recommended that you have your documents ready to show to the officer.

In order to register, you should go to your local immigration registration office and ask for the registration officer as soon as possible following your arrival in Ireland- see ‘Where to apply’ for details of addresses.

You will need to provide the following information about yourself:

The registration officer may also take your fingerprints, signature, and photo and may ask for further details.

On successful completion of your GNIB registration you will be issued with a GNIB Card/residence permit.

Pets are valued members of our family and it’s important that they come with us when we relocate. But there are a number of important steps that you must take in order to get them to Ireland safely and smoothly. Be aware that some airlines in some countries may require you to use a professional pet relocation service which will increase the cost of their trip. But do shop around as quotes can vary greatly. Below is a detailed guide on what is required to move your pets to Ireland based on whether you are coming from an EU or non-EU country and also what type of pet you have. To learn more about the requirements for owning pets in Ireland, go to pet ownership in Ireland.

Your pets may enter any Irish port of entry including airport and ferry terminals.

Your pet must:

Pets being transported into Ireland from a non-EU low-risk country can be brought in under the following conditions.

Your pet must:

You must complete the application form for an import permit within sufficient time to enable the pre-export requirements to be completed.

The bird must:

If your country is not on the non-EU low risk country list then you can only bring your pets into Ireland under strict conditions.

Your pet must:

You must complete and submit the application form for an import permit within sufficient time to enable to pre-export requirements to be completed.

The bird must:

The microchip must be a transponder readable by a device compatible with ISO standard 11785. If your pet has a different type of microchip, your vet can remove it and replace it with an EU compatible chip.

Pet birds are defined as any species except fowl, turkeys, guinea fowl, ducks, geese, quails, pigeons, partridges and ratites reared or kept in captivity for breeding, the production of meat or eggs for consumption, or for restocking supplies of game.

They must not be traded commercially.

These rules apply similarly to those travelling with the aid of assistance dogs. If the dog is accompanying a person from outside the EU, it is advised that they contact Animal Health Section of the Department of Agriculture, Food and the Marine (DAFM) before travelling:

If you are fully compliant with the regulations then your pet will not need to be quarantined. Compliance checks will be carried out within approximately three hours of your pet arriving. Once these checks have been carried out, your pet will be released to you.

If you do not comply with the regulations, then your pet will either be:

Although animals may be excitable on the way to the airport and prior to loading, research has shown that they usually revert to a resting state in their dark, closed cargo hold and subsequently the sedatives may have an excessive effect. Pets travelling by air frequently need veterinary care to recover from the effects of sedation and unfortunately many pets have even died from over sedation.

Some animals can react abnormally from sedation. In addition, the physiological changes from sedatives may be enhanced due to the air pressure inside the aircraft. Increased altitude can also create respiratory and cardiovascular problems for dogs and cats that are sedated or tranquilized. Pug or snub nosed dogs and cats are especially affected.

Sedation can also affect an animal’s natural ability to maintain their balance and equilibrium. When the travel container is moved, a sedated animal may not be able to brace and prevent injury.

Veterinarians suggest pre-conditioning your pet to its travel container instead of sedating. You should do this as far in advance of your trip as possible.

Let your pet get to know the travel container that you will be using by leaving it open in the house with a treat or familiar object inside e.g. a favourite toy. This will encourage your pet to spend time in it. Your aim is to make your pet as relaxed as possible in the container so that their trip is more comfortable.

There are a number of accommodation providers in Ireland that allow pets, but some of them may charge an additional fee to accommodate them. There are also many that don’t allow pets, so make sure that you book well in advance and make it clear how many pets you will be bringing, their breed and size so there is no misunderstanding when you turn up.

When purchasing items online don’t forget to change your delivery address. When setting up your account you would have set the delivery address. Go into your account settings and change it.

The Leap Card can be used on the Limerick urban buses run by Bus Éireann.

The Limerick urban area is covered mainly by buses run by Bus Éireann and a few routes operated by Euro Bus Limerick. The routes service areas such as Raheen, Dooradoyle, Ballycummin, University of Limerick, O’Malley Park, Caherdavin and Castletroy.

You can purchase your ticket from the driver on board the bus, but for a cheaper fare use a Leap Card.

Touch your Leap Card onto the device located beside the driver and tell them where you wish to go. They will deduct the correct fare. You do not have to touch off.

The Limerick suburban rail networks are operated by Irish Rail which provides three lines.

You can purchase your train ticket from the ticket machine, booth or online. There are a range of ticket types that can be purchased including single, return, off-peak, weekly and monthly tickets.

The Leap Card can be used on Galway bus services.

Galway Transport provides information about public transport services currently operating in Galway city and the surrounding area. It includes a summary map of all city bus service routes, a detailed map and timetable link for each route, as well as specific instructions about getting to popular places (work and recreation) using public transport.There are two companies providing bus services throughout the city – Bus Éireann and Galway City Direct. The Leap card can be used on both bus services.

You can purchase your ticket from the driver on board the bus, but for a cheaper fare use a Leap Card.

Touch your Leap Card onto the device located beside the driver and tell them where you wish to go. They will deduct the correct fare. You do not need to touch off.

Irish Rail operates Galways Suburban Rail has a rail line connecting Galway and the satellite towns of Oranmore and Athenry. Currently the Leap card cannot be used for the rail services in Galway.

You can purchase your train ticket from the ticket machine, booth or online. There are a range of ticket types that can be purchased including single, return, off-peak, weekly and monthly tickets.